In somewhat unrelated news, lighting struck the world's biggest Jesus yesterday. More on Brazil below...

To that end, I've reveled in a mass of indicators on a gargantuan Excel spreadsheet from various sources for economic, financial, and democratic indicators. I've only scratched the surface, and already some pretty delicious revelations. Firstly, among the commonly-referred to BRICs (Brazil, Russia, India and China), there is no data to support the conventional thesis that democracy breeds GDP growth (neither net GDP nor per capita). I measured democratization according to the Economist Intelligence Unit's Democracy Index.

Economist Intelligence Unit's 2007 Democracy Index Map (lighter blue indicates higher democracy)

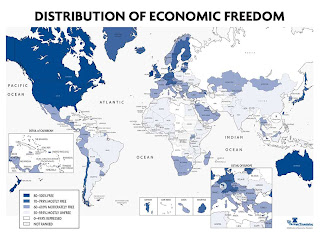

In fact, within this group, the non-democratic states (Russia and China) edged out the democratic states (Brazil and India) in growth, both net and per capita. There is no correlation between degree of democratization and level of economic freedom either (as measured by the Heritage Foundations Economic Freedom Index). Nor is there a strong connection between economic freedom and growth, since all four registered in toward the bottom of all nations in terms of economic freedom.

Heritage Foundation's Economic Freedom Index Map (darker blue indicates higher economic freedom)

There does, however, seem to be a correlation between poverty rates (self-reported, and thus somewhat unreliable) and the UN Human Development Index, and democratization. I'm still working on crunching the Gini Coefficient for economic inequality, but I have an inkling I'll find no real correlation between democracy and economic equality. If that turns out to be the case, this will all make for a true bombshell.

I next examined the "Next Eleven" (N-11) economies (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam) which were slated in 2005 by Goldman Sachs to be the next nodes of emerging market high-growth.

These nations ranked even lower than the BRICs in terms to democratization. Shockingly, among the N-11s, the more-nuanced correlation between lack of democracy and GDP growth was far more pronounced. The "authoritarian regimes" of Egypt, Iran, Nigeria, Pakistan, and Vietnam together clocked rates 5.05% higher net GDP growth than the "flawed democracies" of Bangladesh, Indonesia, Mexico, the Philippines and South Korea (the "hybrid regime" of Turkey fit in the middle, but didn't skew the rates toward either camp since its indicators were all almost exactly average). However, the democratic states did beat out the un-democratic states in per capita GDP growth (by 3.58 %). Perhaps then we have a wash here. Again, with static analysis of the Gini Coefficient, it will become clear whether this translates into higher degrees of economic equality among the democracies.

World map of Gini Coefficient for 2007/2008 (a lower Gini Coefficient correlates with a lower inequality, with yellow nations having the lowest inequality and fushia nations having the highest). Data source: United Nations Human Development Report 2007-2008.

Fascinatingly, the democratic states among the N-11 did show a strong correlation between democracy and growth in economic freedom, but one counter to conventional thinking. The un-democratic regimes grew an average of 5.5 percent over the last decade in the Economic Freedom Index, compared to the democratic regimes, which declined 3.9 percent in economic freedom. Bangladesh and Indonesia declined the most sharply, falling 7.1 and 9.5 percent respectively. The strongest increase in economic freedom was witnessed in the least democratic state among the N-11, Vietnam, with a 9.4 percent increase (albeit from a low starting point).

Next, I've moved to a master spreadsheet of every economy in the world with reliable data (161 at present). Last night I finished entering the indicators for the Economist Intelligence Unit's Democracy Index, Freedom House's Freedom in the World Survey Combined Freedom Status (for 1996-2006), the Heritage Foundation's Economic Freedom Index (for 1996-2008), and UN Net GDP Growth Rates (for 1996-2006). Remaining is to enter the UN and/or World Bank Per Capita GDP Growth Rates, the Gini Coefficient, the Transparency International World Corruption Index, and the UN Human Development Index. After I crunch all those, looking for linear relationships, I'm going to tease out trends within subcategories--by region, religion, labor force, and energy-exporter vs. non-energy-exporter. I'll publish my findings tomorrow.

On of the hypotheses I hope to test is the "Dutch disease" thesis holding that economies (like Russia, Nigeria, Venezuela, and the Gulf states) reliant upon energy exports for their economic growth will tend to suffer from stunted democratization.

Map of Organization of the Petroleum Exporting Countries (Algeria, Angola, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, Venezuela, and Ecuador)

If a more labor-intensive export-led economy like China's spreads the fruits of its growth more widely than a non-labor-intensive export-led economy like Saudi Arabia, then perhaps we'll see a much more rapid journey toward democracy in the Middle Kingdom. Perhaps it will even surpass Russia, reliant as it is today on a rentier economy, and state-led energy export for its economic growth. China shares many characteristics with the Four Asian Tigers of the 1960s and 70s (export-driven growth, high US Treasury Bond holdings, favorable balance of trade, high domestic savings rates, cheap-but-educated labor force, sustained double-digit GDP growth, trade with industrialized nations, etc.). Japan, Taiwan, South Korea, Singapore, Hong Kong, the Philippines, Malaysia, and Indonesia all transitioned toward democracy from authoritarian regimes along a very similar path.

I'm foreseeing a picture wherein the development model works best as it goes through incremental states of political-economy. At first, there is authoritarianism, providing the stability and cohesion necessary to till a infrastructural and macro-economic soil fertile for growth. However, within this authoritarian framework, there is rule of law, economic freedom, and declining corruption. The citizens have legal and economic freedom, but not yet political or civil freedom. As the economic fundamentals are set into place, growth occurs rapidly. The industries responsible for the growth should be labor-intensive and value-added (raw commodity exports won't do the trick), employing the citizenry, giving them "ownership" of the growth, and avoiding the great hoarding of the wealth into government coffers or into the hands of oligarchs (avoiding "Dutch disease"). Entrepreneurship is encouraged, a middle class arises, and the economy becomes increasingly diversified. Thus does a professional citizen class arise: self-sufficient, economically independent, with a stake in the political-economy of the nation. Once this occurs, associative freedom can and does liberalize, allowing these professional stake-holders to inherit the reigns first of civil society and then political society. This is where populism goes astray, allowing too much power in the hands of a mob of people who neither have the stake-holder mentality nor the education and independent means to progress beyond zero-sum identity politics.

This is the path I can foresee for China especially. I think the Beijing government have been responsible stewards, avoiding and attempting to stem the corruption of the provinces (and leaving party leaders who line their pockets hanging from the gallows). They've invested wisely in infrastructure, and allowed metropolitan clusters along the coast to thrive autonomously. They've avoided smothering this growth through either burdensome taxation or statism, but China does not share the same levels of economic freedom that characterized the Four Asian Tigers (and the trend has been static for the past decade, even declining slightly by 0.3% from 1998 levels). Then again, neither do the other BRICs, and the N-11s measure lower than average. A middle class that is projected to be double the population of the United States by 2015 has arisen, and they've been cautious stake-holders in the growth. Beijing has allowed a transition of an enormous number out of poverty in the interior to prosperity on the coast, without allowing the floodgates to open too wide (leading to the urban poverty of so many other Third World slum cities like Lagos). Chinese people have a domestic savings rate of a whopping 50% (large stores of domestic capital liquidity), the government has sizable U.S. Treasury Bond holdings, a very favorable balance of trade (even despite its voracious appetite for energy and raw commodities imports), counts industrialized nations as its largest trading partners, and has reported double-digit growth for the past decade. Once more, its pursued a increasingly popular non-interventionist "just business" strategy in foreign affairs. If the Asian Tiger model is any indication, Chinese Democracy will not just be the title of the upcoming Guns N' Roses album.

Stay tuned...

Might want to look at a comparison of the Economist Intelligence Unit Democracy versus Economic Freedom graph here:

ReplyDeletehttp://www.heritage.org/research/tradeandeconomicfreedom/upload/wm_1861.pdf

Hmm sounds like you're re-inventing the wheel. All this stuff has been covered from ever conceivale angle by academic literature on democratization and political economy...

ReplyDelete